Are you confident that you can cover the cost of life-saving care for your cat? If the answer isn’t a resounding “Yes”, you may want to consider pet insurance.

The best pet insurance could save you thousands of dollars over the course of your cat’s life, giving you both peace of mind and a happier wallet. On the other hand, the wrong wrong pet insurance can be both a headache and a drain on your finances. So how do you choose the right pet insurance provider?

In this article, you’ll learn about the factors that make pet insurance a worthwhile investment and what fine print points you won’t want to gloss over. You’ll also find in-depth reviews of our recommendations for the best pet insurance you can buy for your cat.

At a Glance: Top 10 Pet Insurance Providers Reviewed and Compared

Best Affordable Pet Insurance For Cats

10

Picked by 11 people today!

- Insure your pet in seconds starting as low as $10/month

- Flexible deductibles, reimbursement rate, and annual maximum

- Optional coverage for routine care, and wellness visits

Runner Up

9.8

Picked by 1 people today!

- 90% reimbursement and unlimited payout limits- always

- Customizable deductibles from $0-$1,000, in $5 increments

- The only company that can pay your veterinarian directly, within seconds, at checkout

Best Value Pet Insurance for Cats

9.7

Picked by 1 people today!

- Accident-only, comprehensive, and wellness plans available

- Up to 100% reimbursement for prescriptions and supplements

- Free and unlimited access to Chewy's Connect with a Vet program

Best Pet Insurance for Older Cats

9.5

Picked by 2 people today!

- Offers annual coverage limits of $5,000, $10,000, and unlimited

- Choose an annual deductible of between $100 and $1,500 (reduced by $50 every claim-free year)

- Choose a reimbursement level of 70%, 80%, 90%, or 100%

Best for Deductible Options

9.5

Picked by 1 people today!

- Flexible deductible between $200 and $1000

- Annual payout maximum between $5,000 and $15,000

- Choose a reimbursement percentage of 65%, 80%, or 90%

Most Comprehensive Pet Insurance

9.4

Picked by 3 people today!

- Choice of annual coverage amount – $2500 to unlimited

- Choice of annual deductible amount – $250 to $1,000

- You can choose your reimbursement percentage – 70%, 80%, or 90%

Best Insurance for Kittens and Young Cats

9.3

Picked by 9 people today!

- Offers extensive coverage for many services

- Accepts cats of any age 8 weeks or older

- Easy signup process

Most Reputable Insurance for Cats

9.2

Picked by 1 people today!

- Unlimited annual maximums, but a benefit schedule will limit your benefits per condition $100 or $250 annual deductible

- 90% reimbursement percentage on the comprehensive plan, benefit schedule on all others

Best Pet Insurance for Cats with Pre-Existing Conditions

9.1

Picked by 4 people today!

- Doesn’t exclude any pets, regardless of age or health history

- Comes with a 24/7 lost pet recovery service

- All medical procedures and in-house veterinary services are covered

Best Pricing Flexibility

9

Picked by 11 people today!

- Flexible premiums based on deductibles and limits

- Emergency exam fees are covered

- Optional preventive care coverage in Standard Wellness add-on

Why Trust Cats.com

With three cats to care for, I spend more than I’d like to admit on vet visits. As my cats get older, however, I start to worry that a sudden illness or an injury might require emergency care and expensive treatments. To determine whether pet insurance might be a good option for my own cats, I’ve spent countless hours scouring the market to learn how pet insurance works and what providers are the most trustworthy.

To create this guide, I gathered over 25 quotes and went in-depth to research the top pet insurance providers on the market, evaluating rates, policies, and customer service. I also talked with several veterinarians, insurance customers, and others to learn about their experience with and opinions on insurance for cats. Finally, I scoured review sites, reading hundreds of customer reviews to get a feel for what it’s like to be a customer for each of the providers listed below.

Our Veterinary Advisors

Top Picks Explained

Pet insurance is a rapidly changing industry, so our recommendations change with the times. While this video doesn’t include all of our top picks, you may find it helpful in narrowing down your options.

The Best Pet Insurance for Cats: Our Top 10 Picks

There is no one-size-fits-all in pet insurance. Choosing the best insurance policy for your cat requires cultivating an understanding of the pet insurance business and doing a little self-reflection about your unique needs.

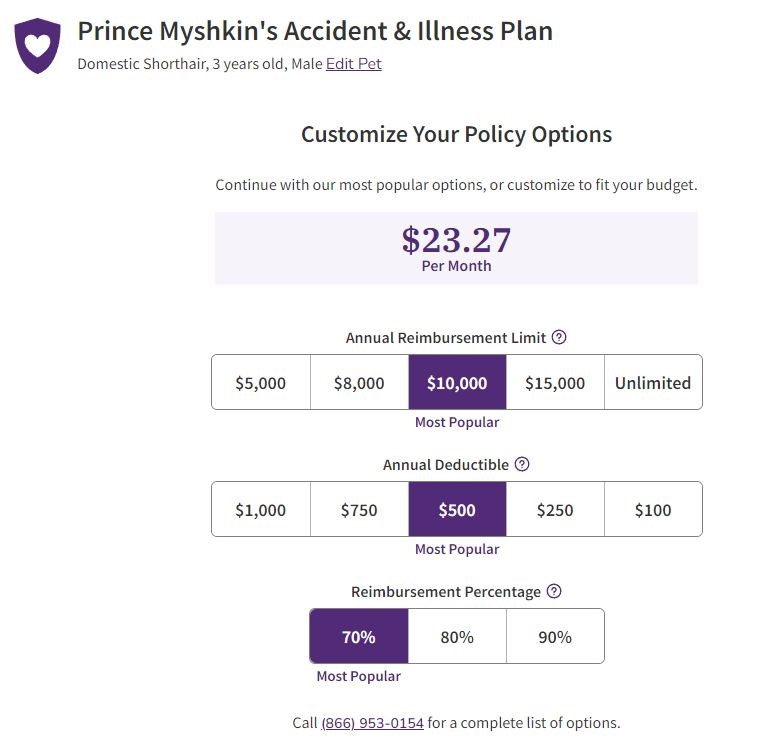

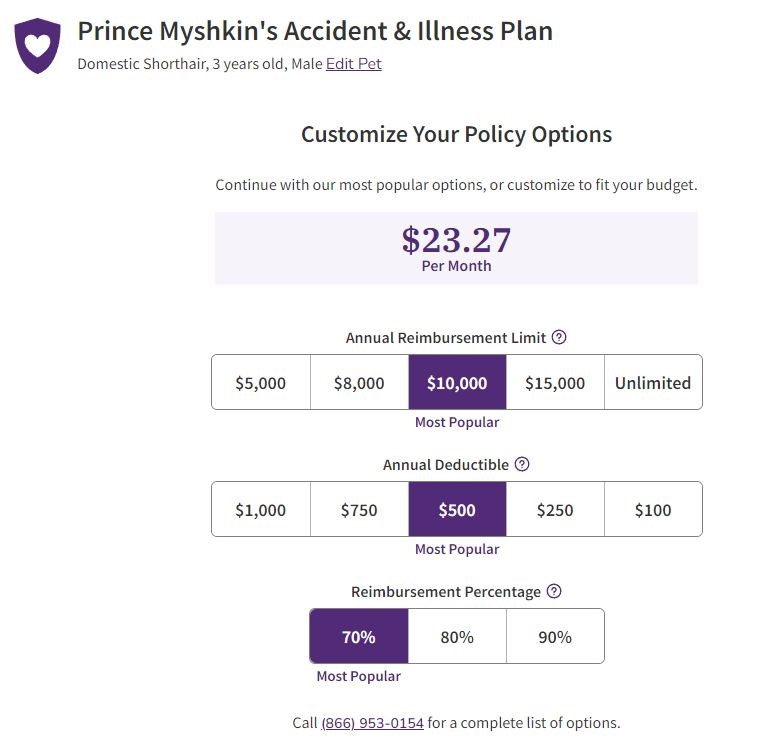

To compare costs, we’ve requested quotes from each company using the same fictional cat profile: a neutered 3-year-old domestic shorthair living in Chicago, Illinois. His name is Prince Myshkin and he’ll be helping us compare the rates offered by the 9 insurance providers on this list.

Known for fast claims payment and their hassle-free digital experience, Lemonade has been called “insurance for the 21st century.” This pet health insurance company has earned 4.4 stars on Google Play and 4.9 stars in the App Store and has been highly rated by Clearsurance, Supermoney, and more.

Lemonade offers competitive pricing on pet insurance for both dogs and cats. Their plans offer extensive coverage for diagnostics, procedures, hospitalization, emergency care, medication, accidents, and illness. With optional wellness plans, pet owners can also save on routine care and wellness exam fees.

Costs

When you fill out your cat’s profile, Lemonade provides you with a starter quote for a premium based on 80% reimbursement, a $250 annual deductible, and an annual max payout of $20,000. You can adjust these values to change your premium.

Here are the options for customizing your plan:

- Reimbursement Percentage: 70%, 80%, or 90%

- Annual Deductible: $100, $250, or $500

- Annual Payout Maximum: $5,000, $10,000, $20,000, $50,000, or $100,000

In addition to your cat’s accident and illness plan, Lemonade gives you the option to add one of two Preventative and Wellness packages for between $10 and $20 per month. Both packages include an annual wellness exam, heartworm test, fecal test, and blood work as well as three vaccinations and access to online medical advice. The more expensive package includes coverage for routine dental cleanings and flea/tick or heartworm medication.

Outside these packages, you can extend your accident and illness coverage to include vet visit fees for around $4/month and physical therapy for around $1.50/month.

What Lemonade Pet Insurance Covers

In terms of coverage, Lemonade is similar to other pet insurance providers we’ve reviewed. Their primary plan covers diagnostic testing, outpatient and emergency procedures, medications, and treatment for accidents and illnesses.

As is true for many providers, Lemonade does not cover vet fees or routine wellness exams, though you can add coverage for an additional monthly fee.

Lemonade does not cover pre-existing conditions, elective cosmetic procedures, or behavioral treatments and they require a full medical exam within 12 months of enrollment before you can use your coverage. There’s a 2-day waiting period for injury, 14 days for illness, and a 6-month waiting period for cruciate ligament injuries.

With Lemonade pet insurance, you can visit any licensed veterinarian in the United States. Claims are filed through the Lemonade app and, for some simple claims, payment is made almost instantly.

What Do Customers Think of Lemonade Pet Insurance?

Lemonade is a popular pet insurance company and is generally well-liked. On PetInsuranceReview.com, customers give it a 4.9/5 rating with 672 reviews. Customers are satisfied with the pricing, customer service, and ease of claim submission.

On Consumer Affairs, Lemonade has a total of 57 ratings with a 4.3/5-star rating. Customers report positive experiences with Lemonade’s customer service with several reporting it is “unlike any other insurance company they’ve worked with.” That being said, there are a few negative reviews from customers who disagree with a claim denial.

Is Lemonade Pet Insurance a Good Choice for Cats?

Overall, Lemonade offers extensive accident and illness coverage for pets along with optional coverage for routine care and wellness visits. Though plans aren’t available yet in all 50 states, customers who choose Lemonade are largely satisfied with the pricing, coverage, and customer service experience.

Pros

- Covers diagnostics, procedures, medications, accidents, and illness

- Optional add-on coverage for preventive care and annual checkups

- Customizable plans with flexible deductible, reimbursement, and annual limit

- Extend your accident and illness coverage to include vet fees for a low monthly fee

- Best pet insurance for multiple cats

- Consistently receives positive customer reviews

Cons

- Like most insurance providers, it doesn’t offer coverage for pre-existing conditions, elective procedures, or behavioral treatment

- Plans aren’t available in all 50 US states

- A new company; may be less stable than more well-established providers

According to the company, Trupanion prides itself on paying out more on the dollar than any other pet insurance company. While these things lead to their higher premiums, you have peace of mind knowing your cat has some of the best coverage for their care. To date, Trupanion has covered more than 750,000 pets and has paid out nearly $2 billion in claims.

It’s the only pet insurance company that pays your vet directly within seconds instead of reimbursing you later, making it an outstanding option for those who don’t want to pay extra upfront. Additionally, Trupanion is set apart from the competition with a per-condition deductible model.

Costs

Trupanion offers a single plan but premiums vary depending on the deductible. When you sign up for a quote, you’ll be given three options. If none of the three suggested prices work for you, you can pick your monthly premium by adjusting your deductible between $0 and $1,000.

This company reimburses 90% of eligible claims and is committed to having no payout limits—ever. All claims are based on veterinary costs in your area, not national averages and customary charges.

Trupanion’s deductibles work on a per-condition basis, rather than annually. This deductible system is good for younger cats with a future of chronic illness but could cost you if your cat already suffers from a series of disparate conditions.

What Trupanion Pet Insurance Covers

Instead of offering three or more policies of differing levels, Trupanion offers a single comprehensive policy that covers surgery, diagnostics, medications, and other treatments for new, unexpected illnesses and accidents.

For customers looking to beef up their policy, Trupanion offers two optional additional coverage riders. The Recovery and Complementary Care rider, which covers various therapies not typically included within traditional policies, including rehabilitative care, acupuncture, chiropractic care, and homeopathy.

The second additional rider is the Pet Owner Assistance rider, which covers expenses outside of the vet’s office, including ads and rewards for lost pets, emergency boarding, liability coverage for property damage caused by your pet, and cremation and burial in the case of your pet’s accidental death.

Note that the company doesn’t offer wellness coverage. The Trupanion site doesn’t shy away from addressing this fact, explaining that “Trupanion was founded to help pets get the emergency care they need, not to help pet owners with routine payments.”

What Do Customers Think of Trupanion Pet Insurance?

On Trustpilot.com, Trupanion has a 4.4/5 rating with over 5,300 reviews and, on Consumer Affairs, has a 3.6/5 rating with 430 reviews. On Yelp, however, Trupanion only has a 2.5/5 rating based on over 1,000 reviews. That’s an average of 3.5 out of 5 stars across all three third-party review sites—an impressively high rating for a pet insurance company.

Like most providers, Trupanion receives its fair share of complaints about denied claims. Negative reviews also suggest a poor customer experience, describing hours spent on the phone, either waiting on hold or struggling to get results out of uncooperative staff.

However, there are also many reviews from customers who have had great experiences with their customer support and love how little they have to spend to get their cat the help they may need.

Is Trupanion Pet Insurance a Good Choice for Cats?

Monthly premiums for Trupanion pet insurance are significantly higher than average but their coverage is also more extensive than many plans. With no limitations on annual or lifetime payouts, this plan has the potential to offer significant savings over the lifetime of your pet. Keep in mind, however, that the per-incident deductible can add up quickly for older cats with multiple health issues.

Pros

- Offers comprehensive coverage

- A well-respected leader in the pet insurance space for more than 20 years

- No payout limits- ever

- 24/7/365 customer service

- Allows you to pay your vet directly, within seconds, at checkout

- Processes the majority of claims within 2 days, many within minutes

Cons

- May be significantly more expensive than other providers

- Deductibles are charged on a per-incident basis

- Limited options for plan customization

*Policies differ in each state. Please review the policy in your state for its coverage.

CarePlus is pet insurance offered by Chewy.com. Plans are currently administered by Trupanion. Chewy’s CarePlus pet insurance is fairly new, having only debuted in the fall of 2022. Though not currently available in all states, in October of 2022, Chewy announced a partnership with Lemonade set to expand coverage and provide a mobile-friendly claims experience.

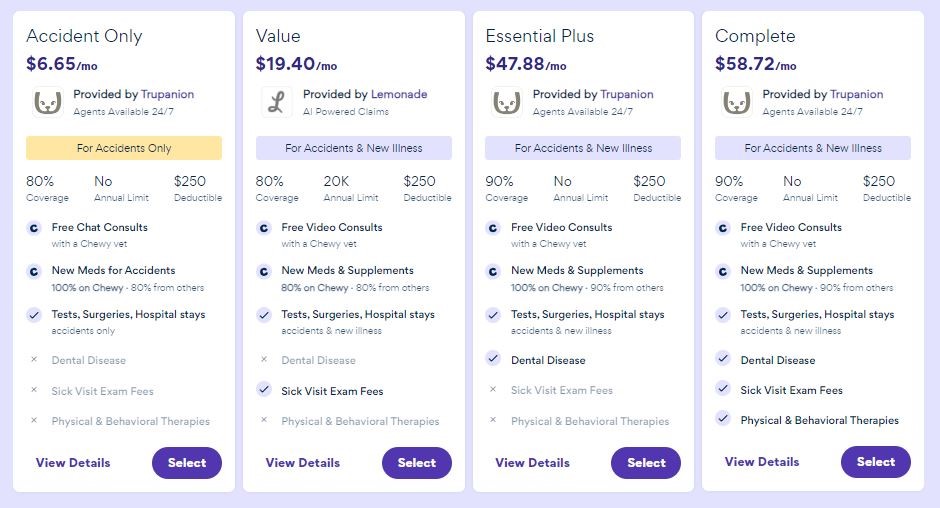

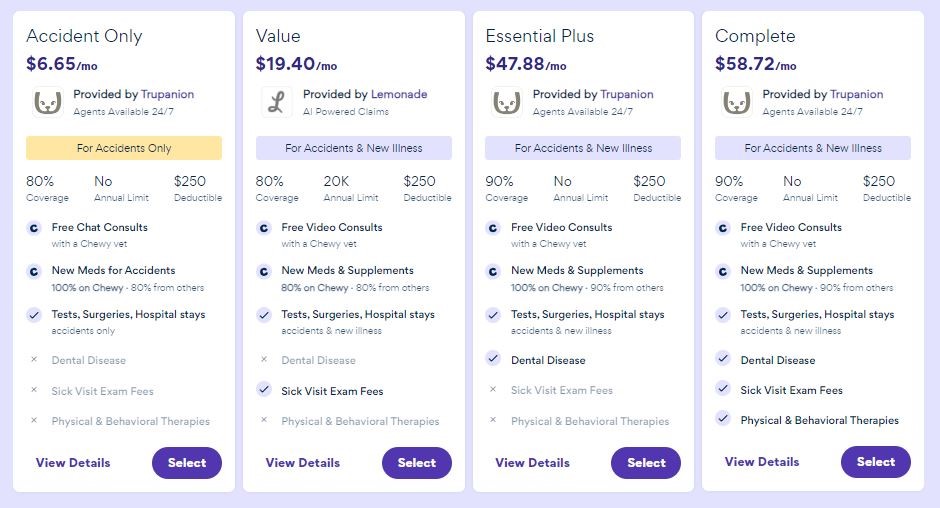

CarePlus offers four levels of coverage in accident and illness plans. Their highest level of coverage costs under $50/month and all but their most basic plan have no annual payout limit. With CarePlus pet insurance, you can visit any licensed veterinarian in the United States. Claims are filed through the Chewy member portal and processed by Trupanion. Direct payments are available, and claims are paid in an average of 3 to 7 days, though many are paid within 24 hours.

Costs

All CarePlus plans, except the Preventative Care plan, include a $250 annual deductible, and there are no annual payout maximums except on the Value plan. The reimbursement rate ranges from 70% to 90%, depending on the tier of the plan you select.

All plans include 100% reimbursement (minus deductibles) for prescription medications, supplements, and veterinary diets purchased through Chewy.com.

In addition to your cat’s accident-only or comprehensive pet insurance plan, CarePlus offers add-on Preventative Care plans for about $20 to $33 extra per month. This plan includes limited coverage for annual checkups, vaccines, blood tests, fecal tests, and flea, tick, or heartworm medications.

What CarePlus Pet Insurance Covers

CarePlus offers one accident-only plan and three tiers of accident and illness coverage. All accident and illness plans cover diagnostic testing, outpatient and emergency procedures, medications, and treatment for accidents and illnesses. All plans also include free live vet access, both video and chat, through Chewy’s Connect with a Vet program.

As is true for most pet insurance providers, CarePlus does not cover exam fees except in their top-tier plan. Neither do they cover pre-existing conditions, elective procedures, or advanced care treatments including physical therapy, chiropractic care, and behavioral treatments.

Though CarePlus requires waiting periods on all plans, several of them are shorter than average. Accident coverage has a 5-day waiting period and illness coverage has a 14-day waiting period. Compared to the 30- to 60-day waiting period most plans require for cruciate ligament or hip dysplasia treatments, CarePlus only requires 14 days.

Two features that make CarePlus pet insurance unique are that it includes access to Chewy’s telehealth chat service, “Connect with a Vet”, and members are eligible for 100% reimbursement on the cost of prescription medications, supplements, and veterinary food purchased on Chewy.com. Considering that very few other providers offer reimbursement on these essentials, it’s an appealing offer.

What Do Customers Think of CarePlus Pet Insurance?

Because CarePlus was launched less than a year ago at the time of this review, third-party reviews of the insurance are still limited. CarePlus has received average ratings from Business Insider and Canine Journal – 3.78/5 and 3.5/5, respectively.

Though CarePlus reviews are sparse, the plans are administered by Trupanion which has a strong reputation in the pet insurance industry. Trupanion has a 4.2 out of 5-star rating on Trustpilot out of over 5,300 reviews. Negative reviews often mention poor customer service, but this issue may be mitigated by the fact that Chewy offers its own 24/7 customer support, available by phone, email, and chat.

Is CarePlus Pet Insurance a Good Choice for Cats?

CarePlus offers a convenient, unlimited pet insurance option for Chewy shoppers. It is likely to be especially cost-effective for those with pets who require prescription medication and veterinary diets. If you’re just shopping for an accident and illness plan, however, you might find lower premiums elsewhere.

Pros

- Standalone, comprehensive, and wellness plans available

- Up to 100% reimbursement on prescription medication, supplements, and veterinary diets

- Free and unlimited access to veterinarians through Chewy’s Connect with a Vet program

- Direct payments available through Trupanion

- Shorter than average waiting periods on cruciate ligament and hip dysplasia treatment

- Quick claims processing, averaging 3-7 days but often paid within 24 hours

Cons

- Only available in 41 states (not in California)

- Like most insurance providers, doesn’t cover pre-existing conditions or elective procedures

While some pet insurance companies don’t offer coverage for pets over a certain age, Figo has no upper age limit. Figo simply states that, when renewing a policy for cats 10 years or older, customers should follow their veterinarian’s advice regarding senior wellness testing.

Figo also offers a few features that don’t come standard among pet insurance providers. For example, coverage comes with the Pet Cloud, a cloud-based medical history and planning application that allows you to manage your cat’s insurance claims and medical life from your smartphone. In addition to medical management, the Pet Cloud is a full-spectrum pet management app with interesting features like 24/7 live vet chat, geolocation, and pet-specific landmark discovery.

Costs

Figo’s policies are fairly flexible and competitively priced. Their recommended plan offers up to $10,000 of annual coverage with a $250 deductible and an 80% reimbursement percentage. For Prince Myshkin, a higher level of coverage with 90% reimbursement, $500 deductible, and no annual payout limit costs less than $5/month more.

Here are the options for creating a custom plan:

- Reimbursement Percentage: 70%, 80%, 90%, or 100%

- Annual Deductible: $100, $250, $500, $750, $1,000, or $1,500

- Annual Payout Maximum: $5,000, $10,000, or Unlimited

For around $6/month you can add coverage for veterinary exam fees and an optional Wellness plan costs about $10/month.

What Figo Pet Insurance Covers

Figo offers three levels of accident and illness coverage as well as a custom plan option. This company covers veterinary fees, emergency care, hereditary conditions, surgery, prescription medications, chronic conditions, specialty care, and other treatments common to most accident and illness coverage. Figo waives the deductible and copay for lifesaving treatment related to accidents or injuries.

If you’d like to beef up your coverage, you can opt for several add-ons for exam fees and routine care. The Wellness plan includes routine care coverage for wellness exams, vaccines, annual diagnostic tests, microchipping, and spay/neuter or dental cleaning.

What Do Customers Think of Figo Pet Insurance?

On PetInsuranceReview.com, Figo is rated 4.4/5 with over 1,900 reviews. Many customers comment on the ease of Figo’s mobile claims processing. The reviews on this site are populated from numerous sources, however. The majority come from Trustpilot.com where Figo is rated lower at 3.8/5 with 1,322 reviews.

Figo has a 3/5 rating on Yelp with 286 reviews. The complaints on Yelp mirror the issues customers note on other review sites. Negative reviews are largely centered around disagreement with claims denial and annual premium increases.

Lexi N. of Encinitas, California, said that: “The platform is easy to use and the customer service is good, no doubt, but unfortunately I cannot continue to be part of a service that raises premiums 50%-100% every year.”

Is Figo Pet Insurance a Good Choice for Cats?

Customer experience with Figo is extremely mixed. What both satisfied and dissatisfied customers seem to agree on, however, is that the mobile claims process is fast and easy to use. That said, premiums do tend to rise each year. Figo may be most cost-effective for young, healthy cats without a history of pre-existing conditions.

Pros

- Offers a great customer support experience

- The PetCloud makes it easy to organize your cat’s medical life

- Short reimbursement wait time

- Flexible policies make it possible to adapt the plan to suit your financial preferences

- Offers a diminishing deductible

- Waives the deductible and copay for lifesaving accident or injury treatment

- Extensive, highly-adjustable coverage

- One of the best options for senior cats

Cons

- A relative newcomer to the pet insurance business—it’s unclear how drastically the provider will change or how premiums will increase as they become established in the industry

When it comes to customization, Embrace offers greater flexibility than many plans. With five options for annual deductibles and annual reimbursement limits, you can adjust your monthly premium to suit your budget.

Embrace also offers a rewards plan with three levels of annual reimbursement for expenses not typically covered by pet insurance plans. Some covered items include wellness exams, spay/neuter surgery, grooming, pet activity monitors, and more.

Costs

Embrace pet insurance plans are highly adjustable, allowing you to carve out the premium and coverage combination that works for you. If you ensure another pet through Embrace, you’ll receive a 10% multi-pet discount on your monthly premium.

Here are the options for customizing your plan:

- Reimbursement Percentage: 70%, 80%, or 90%

- Annual Deductible: $100, $250, $500, $750, $1,000

- Annual Payout Maximum: $5,000, $8,000, $10,000, $15,000 or Unlimited

The company also offers optional coverage for exam fees and prescription drugs, each for around $3 extra per month. Their Wellness Rewards plans offer reimbursement for everyday veterinary, training, and grooming costs at three levels: $250, $450, or $650. The monthly cost for these plans ranges from under $20 to over $50 per month.

What Embrace Pet Insurance Covers

This pet insurance provider offers flexible plans covering unexpected accidents and illnesses. Although the primary plans cover strictly accidents and illness, Embrace offers an additional Wellness Rewards plan, which works as a flexible savings account covering you for up to $650 in routine care expenses.

Note that prescription drug and exam fee coverage is not included in accident and illness plans but is available for a monthly fee.

Cats up to age 14 are eligible for new accident and illness policies and will remain covered as they age, while new applicants over the age of 15 are restricted to accident-only coverage.

What Do Customers Think of Embrace Pet Insurance?

On Yelp, 460 reviewers give Embrace a 2 out of 5 star rating. Of those ratings, over 300 reviewers gave the company 1 star. The brand’s rating on Consumer Affairs is a little higher at 3.5/5 with 316 reviews.

Negative reviews revolve around the provider’s apparent tendency to link unrelated conditions and call them pre-existing, using this as a way to deny claims. Other reviewers describe Embrace as a compassionate, affordable choice.

It’s important to note that Embrace allows you to request a free medical history review at signup. By requesting this review, you’ll learn which conditions will be deemed pre-existing and for how long. If you aren’t happy with the results of the review, you can take advantage of Embrace’s 30-day money-back guarantee.

One of our experts, Kate, is an Embrace customer of three years for her dog, Archie. While she’s had no trouble with the claims process, her monthly premium has increased significantly upon renewal each year.

Is Embrace Pet Insurance a Good Choice for Cats?

Embrace offers some of the most extensive coverage on the market at a reasonable price. Although customer experiences aren’t universally perfect, Embrace has a generally good reputation for processing and accepting claims, providing good customer service, and leaving policyholders satisfied.

Pros

- Includes coverage for hereditary conditions

- Covers a wide range of conditions and treatments

- Reimbursements are based on actual medical costs

- Offers a Healthy Pet Discount Program

- Discounts for multiple pets and active/former military

- Best kitten insurance

Cons

- According to customer reviews, Embrace is inclined to deny claims on the pretense that unrelated conditions are linked and thus pre-existing

- Prescription drug coverage is an additional fee

Originally marketed under the name Petplan, the Fetch pet insurance company was recently taken over by Group Nine Media, the parent company of American media brand The Dodo.

Fetch offers comprehensive pet insurance in one simple plan with several options for customization. What sets this company apart from the competition is that all plans include coverage for veterinary exam fees. Fetch also covers holistic care and breed-specific conditions.

Costs

Fetch is a customizable pet insurance option, though the options are more limited than other companies. Customers can choose from three levels in the three customization categories: annual payout, annual deductible, and reimbursement.

Here are the options for customizing your plan:

- Reimbursement Percentage: 70%, 80%, or 90%

- Annual Deductible: $250, $300, or $400

- Annual Payout Maximum: $5,000, $10,000, or Unlimited

For added savings, Fetch offers a Healthy Pet Credit. For each 12-month period your cat is enrolled without a paid claim reimbursement, Fetch will apply a 15% credit to your premium, up to a total discount of 30%.

What Fetch Pet Insurance Covers

Fetch offers extensive coverage with few exclusions outside the typical. Fetch’s comprehensive coverage includes dental care, dermatology, neurology, alternative therapies, and rehabilitation. In contrast to many providers, Fetch includes veterinary exam fees in their standard coverage.

This insurance provider doesn’t offer wellness coverage, which isn’t necessarily a bad thing. Wellness coverage tends to bump up premiums without offering anything you couldn’t cover with an ordinary savings account.

Unlike most other pet insurance providers, Fetch has no upper age limit, making it worth considering if you’d like to insure an older cat.

What Do Customers Think of Fetch Pet Insurance?

Fetch is a generally well-regarded pet insurance company, but it’s not universally loved. On Trustpilot.com, Fetch is rated 4.3/5 with 955 reviews. Satisfied customers are pleased with the company’s customer service and the ease of Fetch’s claims process.

On Yelp, customer sentiments trend toward the negative, giving it a 2 out of 5 star rating based on 675 reviews. Negative reviews commonly talk about premium hikes and broadly defined pre-existing conditions.

Is Fetch Pet Insurance a Good Choice for Cats?

Fetch isn’t the most customizable pet insurance plan on the market but premiums for young, healthy pets are competitive. If you’re looking for a plan that includes veterinary exam fees or want to offer your pet alternative therapies without an additional monthly fee, Fetch is an option worth considering.

Pros

- All plans cover injuries and illnesses, including those due to hereditary conditions

- Offers highly comprehensive coverage

- Flexible pricing and payout

- Veterinary exam fee coverage is standard

- Dental benefits are comprehensive – not limited to the canine teeth

- Coverage includes alternative therapies

Cons

- Some customers report significant annual premium hikes

- Numerous negative reviews center on claims denials due to broadly defined pre-existing conditions

Launched in the spring of 2020, Pumpkin is one of the newest additions to the world of pet insurance. Owned by the world’s largest animal drug and vaccine manufacturer and headed up by one of the entrepreneurs behind Ollie dog food, this company has roots in multiple parts of the veterinary and pet care industry.

While Pumpkin’s plans are less customizable than others on the market, some customers find the brand’s simplicity attractive. Pumpkin makes enrollment easy and doesn’t exclude things other pet insurance plans do, like exam fees, alternative therapies, and microchipping. For cat owners who are new to pet insurance—especially those with kittens and young, healthy cats—Pumpkin may be a good choice.

Costs

Pumpkin’s insurance rates aren’t very flexible and, while they’re not particularly high in the first place, their monthly rates won’t go as low as those offered by some other providers. All of Pumpkin’s plans include a 90% reimbursement percentage – there are no options to customize this level of coverage.

The options for customizing a Pumpkin pet insurance plan include:

- Annual Coverage Limit: $7,000, $15,000, or Unlimited

- Annual Deductible: $100, $250, $500, or $1,000

You can toggle between three annual deductibles and annual coverage limits, but Pumpkin doesn’t give you a lot of other ways to adjust your coverage. The only add-on is a Preventive Essentials kit which costs around $12/month and has a 12-month minimum.

Customers with multiple pets can save 10% on their monthly premiums by insuring a second pet.

What Pumpkin Pet Insurance Covers

Pumpkin prioritizes simplicity over flexibility. They offer a simple plan that covers accidents and illnesses, including exam fees. Pumpkin’s plans also cover alternative therapies, prescription food, and microchipping at no additional cost.

If you’re interested in wellness coverage, you can tack on Pumpkin’s preventive care pack for an additional monthly fee. This package is much more limited than the typical wellness package, however. It only includes one annual wellness exam, one vaccine, and one fecal test but customers receive a full refund, not the 90% reimbursement rate.

What Do Customers Think of Pumpkin Pet Insurance?

Because Pumpkin is only a few years old, online customer reviews are limited. The brand has 755 reviews on Trustpilot.com with an overall 4.6/5 rating. Even with a limited number of reviews, however, the disparity between 5-star and 1-star reviews is significantly lower than some other brands. Positive reviews mention Pumpkin’s promptness in reimbursing claims and good customer service.

Customer ratings on Yelp trend more negative, with a total of 90 reviewers giving Pumpkin a 2.5/5 rating. Several dissatisfied customers express frustration with the denial of claims for prescriptions that were previously covered. Some customers also reported issues with denial based on pre-existing conditions.

Is Pumpkin Pet Insurance a Good Choice for Cats?

If you’re new to pet insurance, Pumpkin has a few things going for it. Their singular plan keeps things simple and they show you the exact dates your waiting periods will end on the signup page. Though customization options are limited, Pumpkin pet insurance is competitively priced and may be a cost-effective option for kittens and younger cats with no existing medical issues.

Pros

- Offers extensive coverage for cats 8 weeks and older

- All plans include veterinary exam fees

- Enrollment process is easy with clear indication of waiting periods

- High standard reimbursement percentage of 90%

- Multi-pet discount of 10% available

Cons

- Fairly new company with limited customer reviews

- Less customizable than other insurance plans

This well-established company has been selling pet insurance under the VPI (Veterinary Pet Insurance) name since 1982. VPI sold its first policy to a famous dog of the screen—a collie best known for portraying “Lassie”. In 2015, Nationwide discarded the VPI name and rebranded as simply Nationwide Pet Insurance.

Costs

Nationwide’s monthly premiums appear to be in line with the market average but there are some key cost differences to consider. Deductibles are assessed annually, as is typical among pet insurance companies, but annual payouts are defined per condition for both Major Medical plans. In some cases, this could end up being a benefit.

For example, coverage for a cat who experiences multiple separated but minor medical issues won’t be limited by a single annual payout. If your cat experiences a serious health problem, however, Nationwide’s reimbursement may be lower than another plan’s.

If you prefer the simplicity of a typical pet insurance plan, Nationwide’s Whole Pet plan reimburses either 50% or 70% of covered expenses. This plan comes with the standard $250 annual deductible and an annual payout maximum of $10,000.

What Nationwide Pet Insurance Covers

Nationwide Pet Insurance offers three different plans: Major Medical with Wellness, Major Medical, and Whole Pet. All three plans include 24/7 access to Nationwide’s vethelpline.

The Major Medical with Wellness plan covers accidents and illnesses as well as routine preventive care. It provides coverage for wellness exams, vaccinations, bloodwork, urinalysis, and flea and heartworm prevention.

The Major Medical plan is Nationwide’s standard accident and illness plan with limited coverage for some hereditary conditions. The Whole Pet plan is nearly identical except coverage for hereditary and congenital conditions is more comprehensive.

What Do Customers Think of Nationwide Pet Insurance?

Being a big fish in the pet insurance ocean doesn’t make Nationwide Pet Insurance any better than younger companies. In fact, it receives some of the worst reviews in the industry. Out of over 1,000 reviews on Trustpilot.com, Nationwide has a 2.8/5 star rating.

It’s worth taking negative reviews with a grain of salt, however, consider that Nationwide has completely redesigned their plans in the last year or two. Their plans formerly offered a standard 90% reimbursement rate but complaints about denied claims and limitations were common. The new plans leave little room for interpretation when it comes to payout.

Is Nationwide Pet Insurance a Good Choice for Cats?

At first glance, Nationwide may appear to be a more cost-effective option than other plans. Once you consider that annual payouts are limited per condition, however, coverage may be less generous than you might think. It’s important to review your policy thoroughly before you purchase to make sure you know what you’re getting.

Pros

- Three available plans with optional Wellness coverage

- Flexibility of per-condition limits or standard reimbursement percentages

- Policyholders can take advantage of Nationwide’s vethelpline 24/7

- All plans include some degree of coverage for hereditary and congenital conditions

Cons

- Per-condition defined benefits may limit reimbursement in some cases

- Limited and lower-than-average reimbursement percentages

- No option for unlimited annual payouts

With no exclusions, maximums, breed restrictions, or pages of fine print, Pet Assure is a straightforward alternative to pet insurance. You pay a monthly fee, get a membership card, and get a 25% discount on veterinary services at participating clinics.

Rather than a standard pet insurance plan, Pet Assure is a membership program that allows you to receive discounts on veterinary services. If you’ve been in other discount membership clubs like the Good Sam Club, Costco, or Sam’s Club, the model won’t feel too unfamiliar. Because there are no exclusions, it may be an attractive option for owners of cats with pre-existing conditions.

Costs

There are two Pet Assure plans. One covers an unlimited number of pets and the other covers just one. Whether you have one cat, a farm, or a household full of reptiles, Pet Assure gives you the same discount regardless of who’s receiving care.

Your monthly costs will vary, but most plans don’t exceed $10 per month. With a flat rate for multi-pet households, it’s significantly cheaper than paying a different monthly premium for each pet. Most plans limit multi-pet discounts to 10% off your monthly premium.

While insurance could save you 70-90% once you meet the deductible, Pet Assure will pay the same 25% for any expense, regardless of price. This discount can give you some great rewards during routine examinations, dental cleanings, and low-cost bills that might slip under your insurance deductible, it can’t match pet insurance when it comes to major expenses.

For example, if your cat has a bout of urinary tract disease and treatment costs $1,600, you’ll still pay $1,200 with Pet Assure. Assuming a $250 deductible, an insurance provider with an 80% reimbursement percentage would pay $1,080 of the bill, leaving you to cover the remaining $520.

What Pet Assure Covers

Because Pet Assure isn’t a standard pet insurance plan, there are no limits to its coverage. For this reason, it could be a cost-saving measure for cats with pre-existing conditions. It covers all in-house medical services at a standard discount rate of 25%.

Before you get Pet Assure, however, be sure to check for local veterinarians in the network. Unless you live in a densely-populated area, participating veterinarians will be scarce and your regular vet may not be among the few.

For example, our friend Prince Myshkin has access to 16 veterinarians within a 10-mile radius of his home in Beverly Hills. But if he lived in Galena, Illinois, he’d have to travel 38 miles and across state lines to reach the nearest participating vet.

If your current veterinarian isn’t in the Pet Assure network, you may invite them to join.

What Do Customers Think of Pet Assure?

Despite being in operation since 1995, online reviews for Pet Assure are limited. On Trustpilot.com, 85 customer reviews give Pet Assure an average rating of 4 out of 5 stars. On Consumer Affairs, Pet Assure has a 4.1/5 rating with 80 reviews.

Users describe the Pet Assure experience as simple and straightforward, eliminating the need to worry about filing claims and dealing with exclusions. Some negative comments highlight a point that’s worth considering – that some veterinary practices charge more than others for the same services. If there aren’t many in-network veterinarians in your area, it’s worth comparing prices before you pay for a plan.

Is Pet Assure a Good Choice for Cats?

Pet Assure is a no-fuss alternative to traditional insurance. Every pet is welcome, regardless of age, breed, species, or pre-existing conditions. You’ll never have to fill out a form, file a claim, or submit information about your pet’s medical history. Pet Assure is popular among multi-pet families who appreciate the low price and convenience of keeping all of their pets on the same plan. It can also help to ease the burden of catastrophic expenses, but if you’re afraid that a multi-thousand dollar bill will knock you out financially, insurance is probably a better option.

Pros

- Doesn’t exclude any pets, regardless of age or health history

- Comes with a 24/7 lost pet recovery service

- All medical procedures and in-house veterinary services are covered

- No deductibles or limits

- Monthly fees are usually significantly lower than those offered by insurance, especially for multi-pet homes

Cons

- Relatively few vets are in the Pet Assure network, so double-check before bringing your card into a new office

- Some veterinarians may charge more than others

Voted “Pet Insurance of the Year” in both 2022 and 2023’s Pet Independent Innovation Awards, MetLife pet insurance offers pricing flexibility few other companies can match. With reimbursement rates ranging from 50% to 100% and deductibles as low as $50 or as high as $2,500 per year, it’s easy to find a rate that works for you.

Having been in business for over 150 years, MetLife also has a strong reputation in the insurance industry. MetLife first started offering pet insurance in 2019 after buying an existing company, PetFirst, which had been in business for 15 years.

Costs

After providing some basic information about your cat’s age, sex, and breed, MetLife provides you with a basic quote. The plan is based on an 80% reimbursement rate, $250 deductible, and an annual benefit limit of $5,000.

Here are the options for customizing your plan:

- Reimbursement Percentage: 70%, 80%, or 90%

- Annual Deductible: $50, $100, $250, $500, or $2,500

- Annual Payout Maximum: $2,000, $5,000, or $10,00

To customize your plan you can make individual selections or you can choose from preset options like a balanced plan or high-deductible plan. MetLife also offers optional preventive care coverage. The high-deductible plans have the lowest monthly premium.

You can further reduce your premium costs with one of two discounts. The Annual Care Discount is a 10% discount for veterinarians and animal care workers. There’s also a 10% discount for serving military, veterans, first responders, and healthcare workers.

Some customers may qualify for a reimbursement rate as low as 50% for MetGen underwritten policies while IAIC underwritten policies may have a reimbursement rate as low as 65%.

What MetLife Pet Insurance Covers

The coverage MetLife offers is very similar to other pet insurance plans. The standard plan includes coverage for accidents and illnesses but doesn’t cover preventive care. You’d need to choose the Standard Wellness add-on for that.

MetLife’s accident and illness plan covers veterinary bills related to accidents and injuries as well as sudden and chronic illnesses. Unlike some plans, MetLife does cover emergency exam fees and prescription food. The plan also includes holistic and alternative therapies like acupuncture, laser therapy, and hydrotherapy.

Like most pet insurance plans, MetLife doesn’t cover pre-existing conditions and preventive care coverage is not standard. If you choose the preventive care add-on, you’ll receive limited benefits for annual exams and vaccines, spay/neuter surgery, parasite prevention, and dental cleanings.

What Do Customers Think of MetLife Pet Insurance?

Because MetLife only started offering pet insurance a few years ago, reviews for these policies are still fairly limited. That said, MetLife is one of NerdWallet’s top choices, earning 4.5 out of 5 stars for overall performance. Many of the positive customer reviews online are left by pet owners who were specifically looking for a budget-friendly plan.

Is MetLife Pet Insurance a Good Choice for Cats?

Overall, MetLife pet insurance seems to be well-liked among pet owners. Customers appreciate the flexibility to customize the plans with a high-deductible option for maximum savings on premiums. The coverage seems to be similar to other companies.

Pros

- Flexible premiums based on deductibles and limits

- Emergency exam fees are covered

- Optional preventive care coverage in Standard Wellness add-on

- Insure up to three pets on the same plan

- Multiple discounts available

Cons

- Reimbursement rate availability varies

- Like other companies, doesn’t cover pre-existing conditions

- Pet insurance is still fairly new, though MetLife has existed for 150 years

Is Cat Insurance Worth It? What Reddit Users Have to Say

Everyone’s situation is unique, so cat insurance may be more appropriate for some cat owners than others. The decision is entirely up to you, but it may help you make your decision to hear what some real users have to say about some of the pet insurance companies on this list.

Lemonade Customer Review: “The most bang for your buck.”

“I did a lot of digging beforehand and Lemonade was in the top 3 of every top 10 list I looked at and it was consistently the most bang for your buck (ie: Yeah, I could have insured him for $8 a month but it was with a $2k deductible). I live in NY where vets are a bit pricey which is why my base charge was $18 a month but the national average was $14.

I also picked the midrange insurance. I could have paid less and got a $500 deductible or more with a $0 deductible.” – Reddit user u/quitmybellyachin

Embrace Customer Review: “The coverage is easy to understand.”

“I have Embrace now and I’m very pleased with them. The coverage is easy to understand and I haven’t had trouble getting straight answers from anyone on the occasions that I’ve called to ask questions…

They’ve paid out about $1500 without a whimper in my first year, so coverage is already well worth it. I just got my renewal notice, this year’s policy is about $60 higher than last year’s which is a typical increase based on other companies I’ve had in the past.” – Reddit user u/chernaboggles

Fetch Customer Review: “I get reimbursed directly into my account.”

“I’ve had both fetch and trupanion through work. My Fetch plan is much better. The $250 deductible is yearly, vs per issue; the coverage is higher (90% vs 80%) and unlike Trupanion they cover exam fees which is HUGE (my vet charges 150 per exam, and those can really stack up if your pet gets a long running ear infection etc).

My gripe with Fetch is that they request so many medical records. Every time you submit a claim you need new medical records and sometimes they request other completely random documentation. So it takes forever going back and forth with my vet and them, and you kind of have to babysit your claim. You can expect to pay a lot out of pocket and not see money for months.

I get reimbursed directly into my bank account – no paper checks. For me, Trupanion didn’t pay on the spot, I also had to submit claims. However Trupanion was much quicker about approving them with no back and forth or hassle. That was pretty much the only advantage about them.” – Reddit user u/bedlingtonmom

Trupanion Customer Review: “They can pay some vets directly.”

“I LOVE Trupanion. They come highly recommended by vets. They can pay some vets directly so I don’t have to wait to be reimbursed. (Their website has a list of direct pay vets). I did not care for the idea of a per condition deductible, so I chose to get a zero deductible policy. Once you choose your deductible with Trupanion, you can never lower it, but you can raise it later if you want.” – Reddit user u/Tamsin72

Nationwide Customer Review: “I have saved a ton of money.”

“I am not a vet, but I have had a good experience with nationwide. I do not have the wellness plan, I have a plan from my employer but it basically equates to their major medical coverage. Vets don’t choose to cover/not cover- it works differently than your insurance. You pay your vet the same as usual and submit insurance claims after the fact. I have saved a ton of money using nationwide.” – Reddit user u/shellymiscavige

Also Read:

Frequently Asked Questions

Is it worth getting pet insurance for a cat?

Pet insurance can provide cat owners with a safety net against unexpected costs, but it doesn’t always end up being an economic choice. If your pet is young and healthy, the cost of monthly premiums may be unnecessary. For cats prone to serious health issues, however, it can be beneficial as long as your cat’s condition isn’t considered a pre-existing condition.

What is not covered by pet insurance?

No pet insurance plan covers pre-existing conditions which is generally defined as a condition your cat has shown signs of, been diagnosed with, or treated for prior to the plan’s effective date. Many plans also don’t cover routine vet visits or wellness costs.

Does pet insurance cover routine visits?

Most plans don’t, though some pet insurance companies offer separate coverage for routine wellness. Optional insurance coverage may be available for preventive care and alternative therapies such as acupuncture and chiropractic care.

What's the best pet insurance for cats

Though Lemonade is our top pick, there’s no one-size-fits-all in pet insurance. Choosing the best insurance policy for your cat requires cultivating an understanding of the pet insurance business and doing a little self-reflection about your unique needs

Surprised healthy paws was not on the list. Any reason why? Was originally going to move forward with them but now that

I see it wasn’t included in your list I’m concerned. Would love to know why it didn’t make the cut.

Thanks for the comment, Diana! Our picks are based on personal experience with the companies as well as customer comments. We use these comments to get a feel for how the company actually performs on the claims they make about their products. We weren’t able to find enough customer reviews to get a good feel for Healthy Paws versus the other insurance companies mentioned, but we can certainly take a second look in the future!

I just looked at the “Pet Insurance Reviews” page you quote in this article. I noticed that the reviews for a couple companies (esp. Fetch) were top loaded with “10” rated reviews from the same person (Jeri Chen) that submitted what looked like over 100 “10” reviews. That finding does not give me much confidence in the info presented here.

Hi Deb, I’m not sure what you’re referring to. Can you clarify? Sorry about that—I looked through the article and still can’t quite figure out what you mean.

Sorry for the confusion. The article makes reference to a website called “PetInsuranceReview.com” in the discussion about Lemonade Insurance. I took a look at this website and one person (Jeri Chen) has written over 100 (I stopped counting after I got to 100…) “10 star” reviews for Fetch and Trupanion (maybe others as well, but I stopped looking) which clearly skew the overall ranking for these (and other) companies. I have been struggling to find unbiased reviews of pet health insurance companies and was disappointed to find the clear bias in the review website that you referenced.

thank you for the leg work. this is important. i feel nothing is unbiased anymore.

I wish to delete the above comment since I have ruled out PetsBest insurance for my animals and am now leaning heavily toward Embrace.

What put you off pets best?

Hi Kimberly! Pets Best originally was on our list of the best providers, but it has since been replaced by other providers. We’re in the process of updating the review, though, and we may add it back after reviewing 2023 information.

Thanks for the information. I had a kitty with diabetes and insurance would have been great. I also had another cat that didn’t get sick until the day before he passed at 21 years old. I now have a new cat and will take him to the vet in 2 weeks and then I will make my decision.

Yes, there’s so much variation in our cats and needs—there’s no way to predict exactly what each cat needs, but it’s worth it to prepare. Wishing you and your new kitty all the best!

Just want to comment that Lemonade changed their policy and doesn’t have customizing options anymore. It’s a shame because my elder cat is on their previous policy and it has been amazing.

Wow, I know when I first read about pet insurance a week ago, I was looking into it again. My previous 3 rescues had pet insurance, and it worked out wonderfully. Sadly they had passed at ages, 25, 24 and 22. After waiting a couple of years, I did take a rescue in again, he is 13 yrs young, was feral. (or abandoned) tried to purchase health insurance for him, first went to Lemonade because I found them outstanding, but was told they would not insure him. I have tired a couple of others and still no insurance. Doesn’t have any conditions nor illnesses , he’s taken to the vet every year, But the answers come back NO. So, on that note will keep up with appointments to the vet.

You may find that Figo is a better option for him—they don’t have any upper age limits. Hope everything works out well with this new kitty.

Any rateing on Pets Are Us I believe this is the Costco Pet Insurance?

Hi Shirley! Thanks for the comment. Do you mean Pets Plus Us? Since this is an insurance provider selling policies only in Canada, we have not reviewed it here. However, you can see it reviewed in our article on the best insurance for cats in Canada.

So from what these people are saying is your information is not accurate did you check all pet insurance did you really do your digging this says personal experience

While we did not open policies with all of these providers, we did research each one, read reviews from other customers, and gather quotes to get a sense for how all of them compared to one another. Each policyholder’s experience will be somewhat different, so the best we can do is try to piece things together from other user experiences and make inferences from there. Hope this helps!

I would not advise every relying on a web site from any insurer. Call them. Lemonade’s off-shore call center could not describe what a pre-existing condition might be in terms of dental. Gingivitis? Periodontal disease? (We don’t have a list of this, the agent said.) They said they could not point to any specifics on the website or documents. That means you wil be at their mercy when it comes time to putting in a claim. Pass.

Good advice, Suzanne. Many insurers don’t offer lists of what conditions are considered pre-existing because it varies depending on the cat. Usually, it’s anything the cat has been treated for (or shown symptoms of) prior to enrollment.